Jean Paul Goole Equity Fund

The Jean Paul Goole Wealth Equity Fund has been trading since 2009. This fund targets absolute investment returns by focusing on sectors which have anticipated strong growth potential in the short to medium term. Therefore aiming to outperform most major indices whilst still investing into a range of investment sectors to hedge against risk.

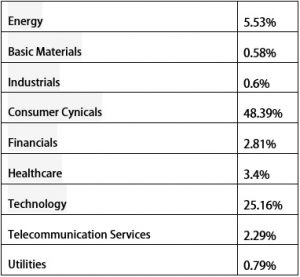

Currently, fund focus has been geared towards consumer cyclicals, focusing on housing, automobiles, retail and entertainment. These areas tend to perform well when market confidence is high and when people feel relatively secure. Fund exposure in this area has risen by almost 20% in the last 12 months. Similarly, this fund is invested into technology stocks, with more than 25% weighting into this sector. It is anticipated that the technology sector will continue to significantly outperform the markets in the next twelve months.

The Jean Paul Goole Equity Fund remains lightweight in industrials, metals and telecoms.

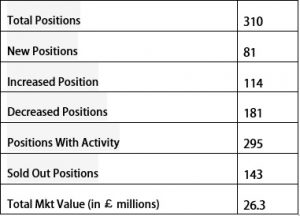

Position Statistics

Sector Weighting

Fund Specifics

The Jean Paul Goole Equity Fund is considered to be a medium to an above average risk investment. Whilst the fun invests into numerous companies over a range of sectors, this investment is not spread evenly or proportionally with each company. This strategy is designed to out perform the market indices. However, such a strategy increases investment risk. This fund is open ended but fund entrance and exit is only permitted during the first week of January. The minimum entrance level starts at £250,000. Please not due to the low levels of liquidity combined with above average risk, this investment is not suitable for all investors. Please speak with your relationship manager to discuss whether it meets your suitability requirements.